The COVID-19 pandemic affected a lot of lives in the country, and paved the way to the “new normal.” Since one of the things that can spread the virus is cash, many people opted to pay digitally. Hence, the pandemic pushed the Philippine government to embrace digital reality. Paymaya, the country’s premier digital wallet, was at the forefront of this crucial change.

More than 50 national and local government agencies have put their trust in Paymaya as their official digital channel for cash-based transactions. These government agencies include the Bureau of Internal Revenue (BIR), Social Security System (SSS), Home Development Mutual Fund or Pag-IBIG, Department of Trade and Industry (DTI), Securities and Exchange Commission (SEC), Land Transportation Office (LTO), Bureau of Customs (BoC), and the Department of Foreign Affairs (DFA). All of them accepts payment through Paymaya for safe and fast cashless transactions.

The total value that has been transacted in the app has increased by 1,200% in December 2020 compared to the same period in 2019.

RELATED: SSS Partners with Paymaya for the SBWS Program

Cash Assistance Through the Paymaya App

Apart from that, the government and several private sectors have tapped Paymaya as the official digital wallet to deliver financial aid to Filipinos who have no bank account, as well as to calamity victims. To date, Paymaya was able to distribute over P4.5 billion in assistance from the Department of Social Welfare and Development (DSWD), SSS, DTI, Department of Agriculture (DA), and Land Transportation Franchising and Regulatory Board (LTFRB), among other agencies, directly to the PayMaya accounts of beneficiaries.

Reaching Far and Wide

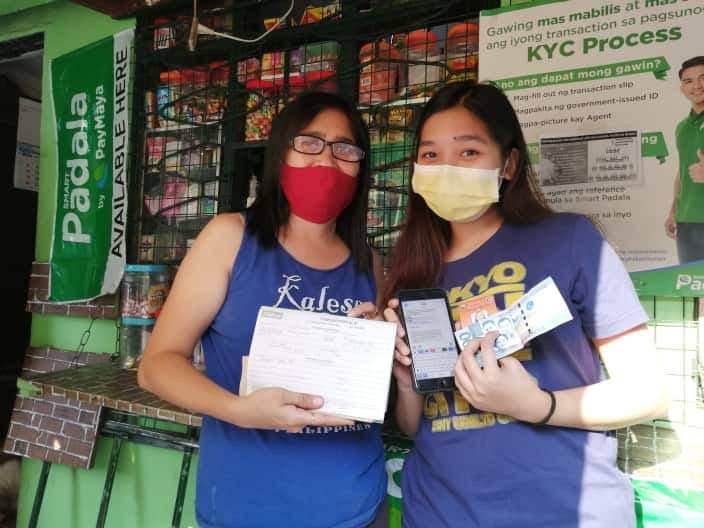

These safe and fast benefits has also reached more Filipinos in 2020, even those who reside in far-flung areas. Paymaya and Smart Padala has over 33,000 partner agents and digital hubs that are of service when needed by Filipinos nationwide. Smart Padala is present in 92% of places in the country and is bound to increase more for more ease and comfort of the people.

“The government has not only made public services more conveniently and safely available in this challenging time but it has also undeniably supercharged the engine for financial inclusion. At PayMaya, we are happy and proud to be one of the main partners of the government for this transformation,” said Orlando B. Vea, CEO and Founder at PayMaya.

Currently, the Philippine government remains open to a cashless society, especially because of the COVID-19 pandemic. “Our country’s digital transformation is propelled by our government’s decisive cashless pivot amid the COVID-19 pandemic. Today, it is not a question of going cashless as consumers and businesses are already choosing digital as their default payment. As the country’s only end-to-end digital payments platform ecosystem enabler, PayMaya serves all – consumers, enterprises, and the government – in the most inclusive way possible,” said Vea.

RELATED: Order Your Jollibee Favorites Via Facebook Messenger and Pay Using Paymaya

Paymaya will continue to be at the forefront of this digital revolution in the Philippines. Filipinos can continue to pay for all government-related transactions through the app while being safe in the comfort of their homes or neighborhoods. Aside from that advantage, what’s great about paying through Paymaya is the perks and rewards such as cashback every time they pay their bills or send money to their friends and loved ones.